Canadian RI (responsible investments) assets pass impressive $1 trillion. Internationally, 92 percent of high net worth individuals want to drive social impact investing, according to the World Wealth report, 2014.

Who is driving social impact investing internationally?

First generation wealth creators (high net worth individuals) look to give back when managing their wealth and want to achieve more than money in return.

Under 40 report driving social good

Internationally, 75 % of high net worth individuals, those under 40 report driving social impact is either extremely important or very important. The tendency declines about 10 percent with each age segment reaching lower percentages, arriving at 45.4% for those 60 and older.

How this impacts investing in 2015?

Impact investments and products are being demanded by investors and consumers internationally.

Top 5 countries driving social impact

India 90.5%

China 89.4

Indonesia 89.2%

Hong Kong 82.1%

Malaysia 81.1 %

Canadian reports support impact investment assets:

$4.13 billion

9.5 percent growth since 2012

87 % of impact investors who target competitive returns either met or outperformed expectations 2013.

Canadian investors and investment managers have numerous RI strategies. Four strategies stand above the rest:

- Corporate engagement & shareholder action is used in the management of 86.5 % of Canadian RI assets. (shareholder influences corporation behavior)

- Executive compensation

- Human rights issues

- Greenhouse gas emissions.

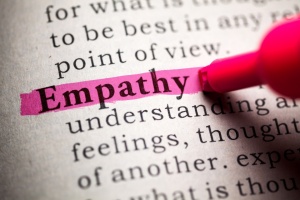

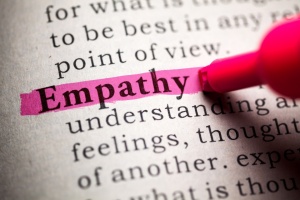

Empathy trend emerging

Large brand strategists identify empathy as one of the four macro trends emerging. Reports state this is because of social networking, and the fact that people can connect with each other, across communities and across the world.

UK testing empathy

Empathy can be tested. Since The Wolf of Wall Street era, times have changed, along with marketing and these days, empathy, understanding, and sensitivity are almost demanded for your business success.

Top One of one hundred

In the UK, 100 of the best known companies were tested for empathy based on three components: customer, employees, and social media. The UK based Linkedin topped number one for empathy.

Empathy embedded in organization

There’s really nothing soft about empathy, and some say it should be embedded into the entire organization.

Empathy trend in Canada

Empathy is catching on in 2015. It’s a good thing – investing and creating more businesses, and companies with empathy.

Video games report a $60 billion industry worldwide.

Markets predict video game companies, and investors will make money on empathy-building games. There are two reasons for this. Parents want them, and they align with the identified market trend towards greater empathy.

$1.7 billion Canadian Video Games industry

With over 90% of kids and teenagers gamers in Canada, there is a trend to help children embrace differences, challenges, and work through things, and be kind. Parents and video game makers continue to request video games with empathy.

Can video games make you a better person?

Minority Media thinks so. Located in Montreal, in Canada is Vader Cabellero, Minority’s creative director who left the big corporate world to make games that are non violent and have “meaningful impacts on people’s lives” – to make players feel something other than aggression. These are called empathy games.

Example of empathy – recognizing and acting on consumer’s emotions

An example of empathy is Dove soap’s self acceptance campaign. Dove tapped into customer’s desires to express positive emotions to others and themselves.

Is empathy key to social media success?

Some say it is, as social media puts the power in the hands of the audience, not the speaker.

- Who are you communicating to? What do they look like?

- What do you want of them? Target your message. Buy vs. learn.

- Where are these people? What language do they speak?

- When or what do you want them do? It may take time.

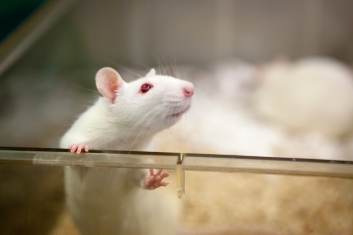

Nurturing empathy

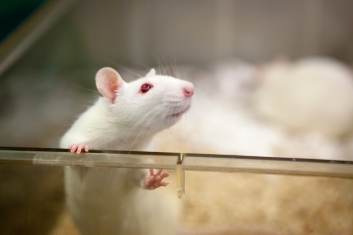

First, it seems hard-wired lab rats will sometimes free a trapped companion before munching on a food treat. So, sometimes, there’s no rhyme or reason to nurturing empathy.

The University of California at Berkeley, Dacher Keltner, says having people think about suffering activates the vagus nerve that is linked to compassion. He also says that uplifting stories about sacrifice boost empathy. Prayer, meditation, and yoga are known to boost empathy. He also says going out into nature appears to encourage compassion.

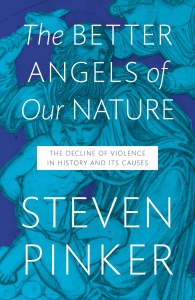

Professor Pinker, in his book, “Better Angels of Our Nature,” explores if affordable fiction and journalism that began in the 18th century helped to expand empathy way back then?

Did affordable fiction and journalism make it easier for people to imagine themselves in the shoes of others? And therefore expand empathy?

The phrase, “the better angels of our nature” stem from US President Lincoln, 1st inaugural address. Pinker in his book uses the phrase as a metaphor for four human motivations that, he writes, can “orient us away from violence and towards cooperation and altruism.”

The four motivations (four better angels) namely:

1. Empathy – gets us to feel pain of others, and align their interests with our own.

2. Self control – anticipate consequences of acting on impulses, and inhibit them as needed.

3. The “moral sense,” and,

4. reason allows us to remove ourselves from our limited, narrow minded vantage points.

Since the 1900s, did affordable books and news help to expand empathy?

Did this give people a chance to see what it felt like to be in somebody elses’s shoes?

Maybe affordable books and news helped to expand empathy in the 18th century. In 2015, it seems empathy is catching on with social media and marketing trends demanding empathy.

So, good bye to The Wolf of Wall Street that had little time to worry about other’s needs, and little empathy. The business world is changing because of the nature of empathy marketing, and investors and customers demanding impact and social investing in their investment portfolios internationally.

87 % of impact investors who target competitive returns, either met or outperformed expectations; 2013.